Introduction

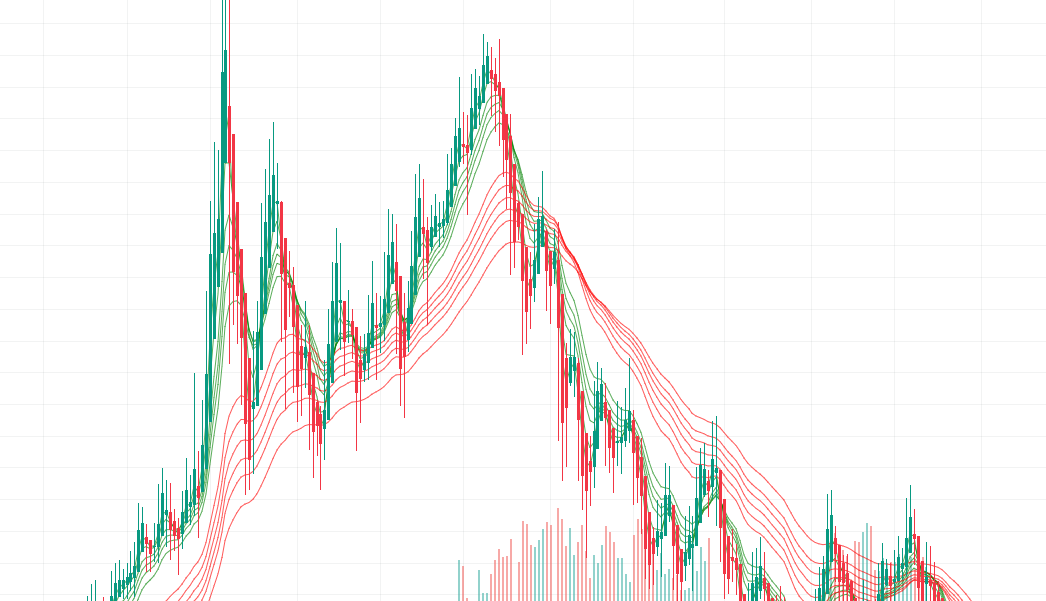

Guppy Multiple Moving Average (GMMA) is a technical analysis tool used by traders to identify changes in market trends. It is based on the concept of multiple moving averages, which are used to measure the momentum of a security’s price action. GMMA is a popular indicator among traders because it can be used to identify potential entry and exit points in the market. It is also useful for identifying support and resistance levels. This article provides an overview of GMMA and how it can be used to help traders make informed decisions.

What is GMMA and How Does it Work?

GMMA, or the Global Market Maker Association, is an international organization that works to promote the development of global markets. The organization is composed of members from a variety of countries and backgrounds, including market makers, brokers, and financial institutions.

The GMMA works to create a unified global market by providing resources and support to market makers and other financial institutions. The organization also works to promote the development of new products and services that will benefit the global market.

The GMMA works to ensure that the global market is efficient and transparent. It does this by providing resources and support to market makers and other financial institutions. This includes providing access to market data, research, and analysis. The GMMA also works to ensure that market makers are compliant with regulations and that they are operating in a safe and secure environment.

The GMMA also works to ensure that market makers are able to provide the best possible service to their clients. This includes providing access to the latest technology and tools, as well as providing support and guidance to market makers.

The GMMA also works to promote the development of new products and services that will benefit the global market. This includes working with governments and regulators to ensure that the global market is well-regulated and that it is operating in a safe and secure environment.

The GMMA works to ensure that the global market is efficient and transparent. It does this by providing resources and support to market makers and other financial institutions. This includes providing access to market data, research, and analysis. The GMMA also works to ensure that market makers are compliant with regulations and that they are operating in a safe and secure environment.

Overall, the GMMA is an important organization that works to promote the development of global markets. It provides resources and support to market makers and other financial institutions, as well as promoting the development of new products and services that will benefit the global market.

Benefits of Using GMMA for Technical Analysis

The Guppy Multiple Moving Average (GMMA) is a technical analysis tool that is used to identify changes in the strength and direction of a trend. It is a popular tool among traders and investors, as it provides an easy way to identify trends and determine entry and exit points.

The GMMA is based on the concept of moving averages, which are used to smooth out the price action of a security over a given period of time. The GMMA consists of two sets of moving averages, a short-term set and a long-term set. The short-term set consists of six exponential moving averages (EMAs) that are set at 3, 5, 8, 10, 12, and 15 periods. The long-term set consists of six EMAs that are set at 30, 35, 40, 45, 50, and 60 periods.

The GMMA is used to identify changes in the strength and direction of a trend. When the short-term EMAs are close together, it indicates that the trend is weak and may be about to reverse. When the short-term EMAs are far apart, it indicates that the trend is strong and may continue. When the long-term EMAs are close together, it indicates that the trend is weak and may be about to reverse. When the long-term EMAs are far apart, it indicates that the trend is strong and may continue.

The GMMA is a useful tool for traders and investors, as it provides an easy way to identify trends and determine entry and exit points. It can also be used to confirm the strength of a trend and help traders decide when to enter and exit a trade. Additionally, the GMMA can be used to identify potential support and resistance levels.

Overall, the GMMA is a useful tool for traders and investors, as it provides an easy way to identify trends and determine entry and exit points. It can also be used to confirm the strength of a trend and help traders decide when to enter and exit a trade. Additionally, the GMMA can be used to identify potential support and resistance levels.

How to Use GMMA to Identify Market Trends

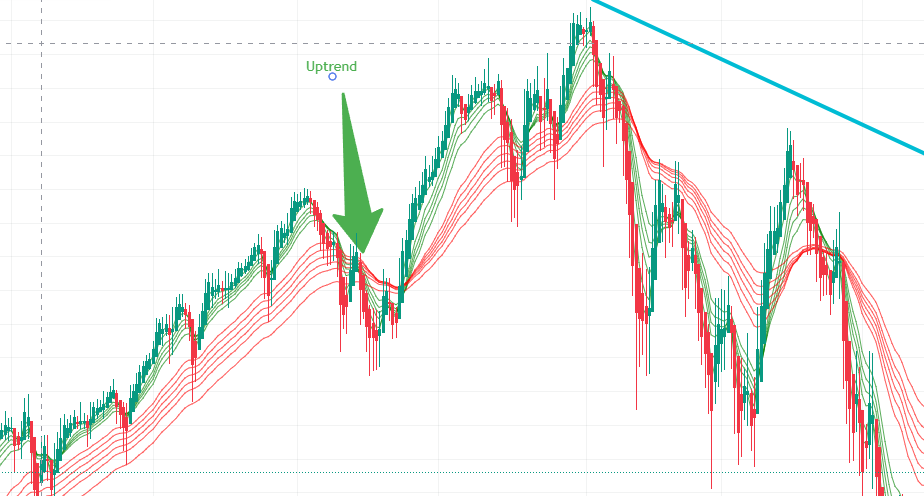

The Guppy Multiple Moving Average (GMMA) is a technical analysis tool used to identify the overall trend of a financial market. It is a combination of two sets of moving averages that are used to identify the direction of the trend and the strength of the trend. The GMMA is a popular tool among traders because it can be used to identify both short-term and long-term trends.

To use the GMMA, you will need to plot two sets of moving averages on a chart. The first set of moving averages consists of short-term averages, such as the 5-day, 10-day, and 20-day moving averages. The second set of moving averages consists of longer-term averages, such as the 30-day, 50-day and 200-day moving.

When the-term averages are above the longer-term averages, it indicates that the market is in an uptrend.

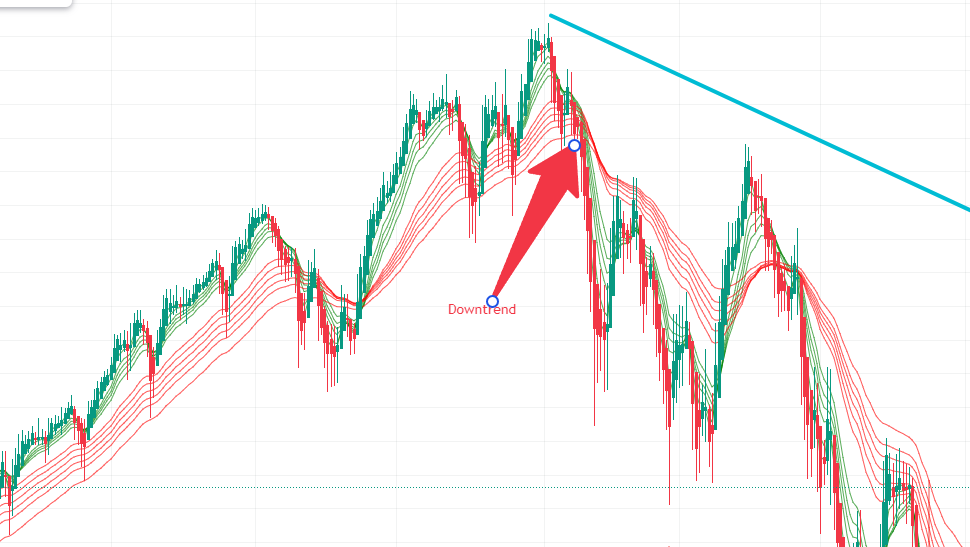

Conversely, when the-term averages are below the longer-term averages, it indicates that the market is in a downtrend. The strength of the trend is determined by the distance between the two sets of moving averages. The wider the distance between the two sets of moving averages, the stronger the trend.

The GMMA can also used to identify potential reversals in the trend. When the short-term averages start to cross below the longer-term averages, it indicates that the trend may be reversing. Similarly, when the short-term averages start to cross above the longer-term averages, it indicates that the trend may be reversing.

The GMMA is a powerful tool for identifying market trends. It can be used to identify both short-term and long-term trends, as well as potential reversals in the trend. By plotting the two sets of moving averages on a chart, traders can quickly and easily identify the direction and strength of the trend.

Strategies for Trading with GMMA

The Guppy Multiple Moving Average (GMMA) is a technical analysis tool that is used to identify changes in the strength, direction, momentum, and duration of a trend in a financial market. It is composed of two sets of moving averages, one short-term and one long-term, that are used to measure the strength of a trend.

The GMMA can be used by traders to identify entry and exit points in a market, as well as to assess the strength of a trend. It is a popular tool among technical traders, as it provides a visual representation of the trend and can be used to identify potential reversal points.

When trading with the GMMA, traders should focus on the relationship between the two sets of moving averages. When the short-term moving average is above the long-term moving average, it indicates that the trend is strong and that the market is likely to continue in the same direction. Conversely, when the short-term moving average is below the long-term moving average, it indicates that the trend is weakening and that the market may be about to reverse.

Traders should also pay attention to the distance between the two sets of moving averages. When the distance between the two sets is increasing, it indicates that the trend is strengthening. Conversely, when the distance between the two sets is decreasing, it indicates that the trend is weakening.

Traders should also look for divergences between the price action and the GMMA. When the price action is making higher highs but the GMMA is making lower highs, it indicates that the trend is weakening and that the market may be about to reverse. Conversely, when the price action is making lower lows but the GMMA is making higher lows, it indicates that the trend is strengthening and that the market may be about to continue in the same direction.

Finally, traders should also pay attention to the crossovers between the two sets of moving averages. When the short-term moving average crosses above the long-term moving average, it indicates that the trend is likely to continue in the same direction. Conversely, when the shortterm moving average crosses below the long-term moving average, it indicates that the trend is likely to reverse.

By using the GMMA in combination with other technical analysis tools, traders can identify potential entry and exit points in a market. It is important to remember, however, that the GMMA is only one tool in a trader’s arsenal and should not be relied upon exclusively.

Understanding the Different Types of GMMA Indicators

The Guppy Multiple Moving Average (GMMA) indicator is a technical analysis tool used to identify changes in the strength and direction of a trend. It is composed of two sets of moving averages (MA) – one short-term and one long-term – that help traders to identify the direction of the trend and its strength. The GMMA indicator is used to determine whether a market is trending or not, and to identify potential entry and exit points.

The GMMA indicator is composed of two sets of moving averages. The first set is composed of six short-term exponential moving averages (EMA) with periods of 3, 5, 8, 10, 12, and 15. The second set is composed of six long-term exponential moving averages with periods of 30, 35, 40, 45, 50, and 60. These two sets of moving averages are used to identify the direction and strength of a trend.

When the short-term moving averages are close together, it indicates that the market is in a range-bound state and is not trending. When the short-term moving averages are diverging, it indicates that the market is trending. The longer the short-term moving averages remain diverging, the stronger the trend is considered to be.

The long-term moving averages are used to identify potential entry and exit points. When the long-term moving averages are close together, it indicates that the trend is weakening and a potential exit point may be near. When the long-term moving averages are diverging, it indicates that the trend is strengthening and a potential entry point may be near.

The GMMA indicator is a useful tool for traders who are looking to identify changes in the strength and direction of a trend. It can be used to identify potential entry and exit points, as well as to determine a market is trending or not. The GMMA indicator is a valuable tool for traders who are looking to capitalize on market trends.

Excerpt

GMMAs are a type of technical analysis tool used to identify trends in the market. They use a combination of short-term and long-term moving averages to provide traders with an easy-to-understand visual representation of the current market trend. With GMMAs, traders can quickly identify entry and exit points their trades.